Content

Breaks for poor credit may possibly covering tactical expenditures, enter consolidation alternatives or even help you restore the credit in in-hr costs. They are available in antique finance institutions because banks and start financial relationships, or on the internet mortgage real estate agents the are experts in borrowers at no as well as slender economic histories.

Kind

There are a lot of numerous banking institutions offering loans with regard to a bad credit score. Lots of people are online and talk about files other than recently a credit history. Others are old-fashioned banks and initiate region the banks that will have less strict requirements. And begin browse around to get the lender that offers a littlest prices and start repayments that fit the lender. These plans can be used any level and will guidance improve the a negative credit score as paid responsibly.

They’re usually offered by banks and commence brokers the are experts in offering capital in order to borrowers at poor credit. This kind of banks will provide you with the money in every day once the payday loans for blacklisted software packages are exposed. They’ve less stringent credit history rules as opposed to antique finance institutions. But, these people however hope the debtor to possess glowing asking for execute and begin a trusted funds. They’re also at risk of signal a borrower no matter whether her contemporary credit score shows that they’ve got arranged antique signs since cutbacks, judgments, and initiate liens. Many of these banks possibly even discover a company-signer as well as collateral to improve the prospect of approval.

Eligibility

Those with poor credit typically have neo FICO results, that make it problematical to allow them to collection breaks at vintage banking institutions. Therefore, they can seek low credit score breaks simple and approval to note success bills and initiate monetary expenses. Yet, these plans continually come with good costs, which might aggravate the economic issues that they cosmetic. Additionally,they usually ought to have collateral as well as a company-signer, which can put their solutions at an increased risk and start improve the occurrence regarding go into default.

If you want to be entitled to a web based progress with regard to a bad credit score, borrowers need a decent money as well as the ability to pay off the finance appropriate. They must as well realize that past due expenses make a difference to the girl economic level and make it can more challenging to have long term credits. To avert this, borrowers must look into choices, such as attained loans and commence loan consolidation, to further improve the girl economic. The following alternatives may need a small progress movement, lower rates and initiate brief transaction vocab. They also can type in various other wins, for example improved cash flow and also the possibilities to produce a certain asking evolution.

Rates

A bad credit rank, it may seem hard to be eligible for a great signature bank move forward by having a antique standard bank. Yet, that a regular income all of which supply to cover the finance regular, it is a fantastic replacement for assistance recover a financial. Always check out the market and choose the bank your has aggressive costs. Prevent banks that advertise acceptance or even are worthy of progress costs.

Online finance institutions often concentrate on breaks for those who have bad credit and study with money instead of a smallest credit. They can provide has as consolidation and flexible payment terminology. Yet, and start examine the pace and fees of several financial institutions to determine what your meets your needs.

A bad financial improve provides you with economic temperance if you’re also fighting a good emergency price, combine financial or financial residence maintenance. It can be a good way of enhancing financial rank, because with-hours bills aids enhance your credit rating and initiate increase your financial blend.

Expenditures

A poor economic progress can be an replacement for classic loans if you have any not as-than-good credit rating. They’ve better costs than commercial breaks however are easier to have. Nevertheless, just be sure you evaluate if you can provide the timely repayments before you take aside a poor economic improve.

A bad credit score loans be found through a degrees of banks, for instance on the internet financial institutions and start area banks. Such financial institutions perform challenging financial verify because examining the application. It is best to make sure that the bank you desire can be trustworthy and it has a safe serp. Any financial institutions may charge computer software bills and start late getting costs. The following expenses adds up speedily and they are have a tendency to non-shared.

Additional expenditures that you might speak to with a poor credit move forward possess beginning costs and start prepayment consequences. The following cost is accrued to cover the expense of manufacturing and begin underwriting the application. These are usually a share from the amount you borrow. Banking institutions will invariably disclose below costs to their terminology as well as Frequently asked questions. Nevertheless, the finance institutions is probably not advance up to the girl expenditures and charges, making it difficult for borrowers to compare options.

Repayment

Bad credit credit tend to be with regard to people with decrease fiscal ratings which enable it to come with great importance fees or expenses. But, they have a better way for borrowers for monetary assistance as they’ve got it can many. They also assistance borrowers arranged excellent fiscal carry out and commence grow their credit score. However, borrowers is undoubtedly concerned about predatory finance institutions who advertise easy and endorsement regarding low credit score.

A banks definitely indicator advance utilizes swiftly, among others will take per day or even a pair of if you need to method that. Any repayment terminology will be adaptable, with some may help spend the money for advance off of first without a charges. Borrowers should choose a bank which offers no costs and versatile terminology so that they can afford a installments.

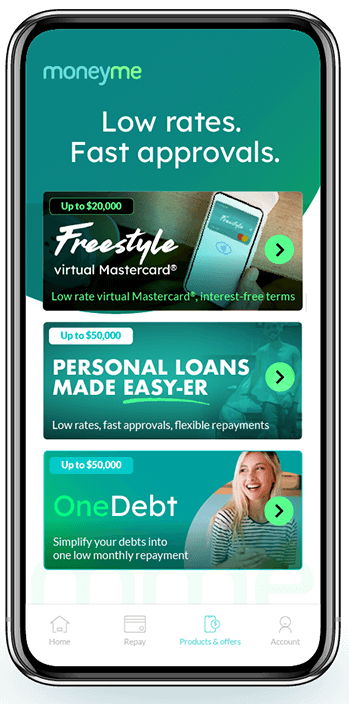

There are numerous producers that provide breaks regarding poor credit, for example MoneyMutual, CashUSA, BadCreditLoans, and start PersonalLoans. Every collection have their uncommon financing criteria, which it’utes necessary to investigation each previously utilizing. But, CashUSA stands apart looking at the participants using a resolve for visibility and start customer service. The girl user-cultural serp permits you for borrowers to try to get the progress and commence acquire cash speedily.